June 10, 2022

With Nat Gas Pricing at 14-Year Highs, More Production is Coming. Or is it?

By Jeff Bolyard, Principal, Energy Supply Advisory

This post by Jeff Bolyard, Principal, Energy Supply Advisory, is featured in our recently released June 2022 Monthly Monitor, which includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets. To read the full newsletter, click here. To sign up for the Monthly Monitor distribution list, click here.

On May 26, the June 2022 natural gas contract came off the futures board with a final settlement of $8.908 per MMBtu – the highest a June contract has settled since 2008 – when it closed at $11.91. Back then, the high prices were not a result of high demand or even a hurricane that knocked off supply. Rather, it spiked in the financial meltdown that year when investors kept pouring money into commodity futures to avoid the risks of traditional stocks.

Historically, producers would react very quickly to spikes in natural gas pricing, incurring significant debt to chase the potential profit. The result of this rapid producer reaction would result in a jump in production, thereby reducing the price relatively quickly.

Natural gas prices have been well over the average breakeven price for producers for about nine months now: the current price is at a 14- year high – more than five times the price than just two years ago in 2020.

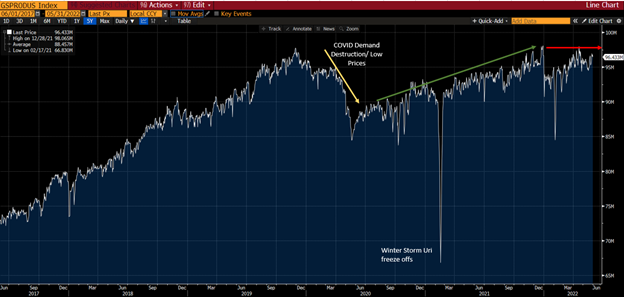

The Bloomberg chart below shows domestic natural gas production since 2017. Reduced demand and low prices sent production tumbling in 2020 (yellow arrow). As demand recovered in 2021, production followed price increases (green arrow), with the exception of a short-term blip in February 2021 caused by Winter Storm Uri freeze-offs. Production peaked at the end of 2021, at just over 98 Bcf per day.

U.S. Natural Gas Production 2017-present (Bcf per day)

Although the June NYMEX settled at 14-year high and the next eight months in the forwards are all trading well over $8/MMBtu, production has stalled since the start of the 2022 (red arrow).

There are several factors playing into the lack of production growth this year. Highlighted below are a handful of reasons:

- Inflation: Even though most producers have increased capex in 2022 by 20-30% over the prior year, inflation is eating up to 40% of that increase.

- Labor shortage: During the lean year of 2020, experienced field / frack crews were either laid off and found other careers or retired altogether. There is now a shortage of fracking crews available to complete and maintain wells.

- Newfound financial discipline: After many producers went bankrupt in 2020, while others restructured and implemented significant cost-cutting, the class in general is placing the current wave of positive cash flow into paying off debt, rewarding remaining stockholders, and maintaining or slightly increasing production plans. There is still significant concern among producers that the timeline and political atmosphere to recover the long-term investment required to significantly grow production does not exist in the current transition plans to a greener economy.

- Limited other fuel options: The U.S. Commerce Department investigation into potential solar panel tariff circumvention has removed significant amounts of planned solar generation from the stack over the next two years, while the production and stockpiles of coal are not large enough to meet growing peak power demand. Both of these factors place more demand on natural gas to fill the growing gap.

- International geopolitical events: Russia/Ukraine war, OPEC price manipulation, Europe’s reliance on imported energy, COVID-induced supply chain issues. . . need I say more?

In summary, there is no magic pill that the energy market can take to correct the current high price of energy in the short term. Until domestic natural gas production increases or demand for fuel decreases, high prices can be expected to continue. Those who are willing and able should consider a longer-term strategy that looks at pricing further out. As an example, 2024-2027 is trading at an average price of $4.38 per MMBtu, which is about half the current price.

Join Our Mailing List

Download the June 2022 Monthly Monitor

A newsletter that includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets.

Learn More