April 10, 2023

Natural Gas Short-Term Energy Outlook

By Jeff Bolyard, Principal, Energy Supply Advisory

This post by Jeff Bolyard, Principal, Energy Supply Advisory, was featured in our April 2023 Monthly Monitor, which includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets. To read the full newsletter, click here. To sign up for the Monthly Monitor distribution list, click here.

This post by Jeff Bolyard, Principal, Energy Supply Advisory, was featured in our April 2023 Monthly Monitor, which includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets. To read the full newsletter, click here. To sign up for the Monthly Monitor distribution list, click here.

Each year, the Energy Information Administration (EIA) puts out a Short-Term Energy Outlook (STEO) that attempts to provide an overview of the state of energy in the U.S. over the next 12 months. This forecast looks at historical usage and weather patterns, overlays the current state of the supply/demand balance based on what is known and anticipated to occur, and provides plenty of analytical fodder for energy geeks to mull over. Ultimately, this forecast – like every forecast that relies on assumptions and variables that will inevitably change – will be wrong.

Nevertheless, it is a good baseline to start with and provides some valuable detail on the state of where we are in the natural gas market today.

This month’s writeup unpacks some of the more compelling pieces of the EIA STEO issued on 3/7/2023, with a focus on several of the natural gas components of that report.

But first, a short synopsis on how we got to the current lower-price environment.

Consumption of natural gas in January and February 2023 was well above norms for the typical dead of winter. Driving this was extremely mild temperatures, which NOAA indicates were among the three warmest on record going back 128 years. The residential commercial sector – a significant user of natural gas during the winter – was most visibly impacted, using 9.9 Bcf less per day in January and 6.5 Bcf less per day in February 2023 than those same months in 2022.

This low usage start to the year allowed the domestic storage balance to flip from a YOY 114 Bcf deficit at the beginning of the year, to a surplus of 532 Bcf just 10 weeks later. Unsurprisingly, the natural gas NYMEX futures fell significantly.

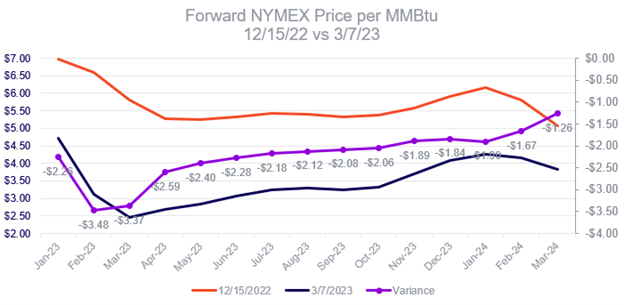

The chart below compares the forward price on 12/15/2022 (blue line) and the forward price of gas on March 7, 2023 (orange line), including the final settlements of Jan, Feb, and Mar 2023, which were known on March 7 – the date of the EIA STEO publication. The chart highlights the significant market change that was factored into the report, with the gray line representing the price variance by month in the forwards that occurred in under three months.

Now, on to the highlights of the EIA STEO forecast for the next 12 months:

- Production is expected to average 100.67 Bcf/day in 2023 – an increase of 2.6 Bcf/day over 2022 averages and growing by another 1 Bcf/day in 2024.

- Domestic consumption in 2023 is predicted to decline by 2.1 Bcf/day vs. 2022, primarily due to the extreme mild weather already baked into Q1 2023, with much lower Res/Comm usage already known.

- Exports of natural gas are expected to grow by 1.99 Bcf/day in 2023. Although very few new LNG export projects will be fully commissioned this year, the restart of Freeport should make up the bulk of this increase with some incremental in Q4, potentially from either Golden Pass or Calcasieu Pass LNG projects, and another 500k/d of exports via pipeline.

- EIA anticipates that power demand in 2023 will average 32.51 Bcf/day – 0.69 Bcf/day lower than the 2022 average. However, I would be hard-pressed to see that materialize at the current bargain basement pricing seen in the forwards for natural gas today.

- And the EIA Henry Hub price forecast for 2023 is . . . $3.02/MMBtu. If this holds true, producers will invest less, drill less, and ultimately produce less down the road, which may be why the EIA is forecasting 2024 prices to average $3.89/MMBtu. For what it’s worth, the Cal 2024 price in the forwards is currently trading at $3.60 (as of 3/29/23 intraday).

As said in recent writeups, volatility is here for a while. While prices are currently relatively low, anyone who doesn’t want this volatility to continue should take a look at the current price opportunity being provided.

Contact Edison Energy today to learn more!

Join Our Mailing List

Download our April 2023 Monthly Monitor

A newsletter that includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets.

Learn More