May 13, 2020

PJM MOPR Ruling: Compliance Filing & Recent FERC Order Bode Well for Buyers

By: Shannon Weigel, Director of Policy, Edison Energy

This blog is part of an ongoing series on energy policy and legislation. To read more from the series, click here.

On December 19, 2019, the Federal Energy Regulatory Commission (FERC) ordered changes to PJM’s capacity market rules that will subject all new state-subsidized resources to a “minimum offer price rule” (MOPR). Under the order, all new state-subsidized resources will be subject to the MOPR, which will create an artificial price floor for these resources in future capacity auctions. While this price floor is beneficial for traditional generators previously impacted by price suppression, there is significant risk that new wind and solar projects will be barred from earning revenues in PJM’s capacity market.

FERC’s order has created uncertainty surrounding the capacity revenue that new projects can expect to receive, and developers have reacted differently to this uncertainty, which is reflected in recent PPA pricing changes. Wind PPAs are minimally impacted by this order because wind projects generally assume little to no capacity revenue. However, virtually all solar offers in PJM assume some capacity revenue given their on-peak generation profile, so the order is putting upward pressure on solar PPA rates as developers reassess their capacity value assumptions.

On March 18, 2020, PJM filed a compliance filing outlining its implementation of FERC’s 2019 Order and clarified some outstanding issues. On April 16, 2020, FERC denied rehearing requests from numerous stakeholders on their MOPR Order, allowing stakeholders to file lawsuits at the U.S. Court of Appeals for the District of Columbia Circuit. On the next page we share how the renewable PPA market is reacting to these recent filings.

Developers are gaining confidence with voluntary renewable purchases in PJM, despite ongoing regulatory uncertainty.

In FERC’s April 2019 Order denying petitions for rehearing, FERC clarified that “purely voluntary transactions for RECs are not considered State Subsidies,” and therefore do not trigger the MOPR. FERC explicitly highlighted a pathway for exemption for these voluntary renewable transactions, called the Competitive Exemption (described on the following page). With this positive news, developers are eager to see the final ruling from FERC, which could occur in mid-June at the earliest.

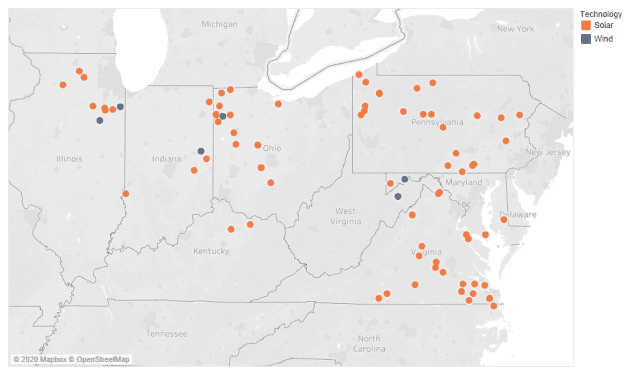

PJM Project Offers Received in the Past Six Months

PJM Project Offers Received in the Past Six Months

Developers are still weighing options to seek exemption from the MOPR, which may lead to revised PPA pricing in the near-term.

Under PJM’s compliance filing, there are three pathways for renewable projects to be granted exemption from the MOPR:

Existing Renewables

Projects with signed interconnection agreements are exempt from the MOPR, regardless of if they are receiving state subsidies, and this exemption will last the life of the project. There is a finite pool of projects that meet this exemption.

Competitive Exemption

Projects certify that the new resource will forgo any state subsidies may be exempt from the MOPR. PJM’s tracking system, GATs, will be modified to “tag” the project’s RECs to ensure they cannot be retired into a state renewable portfolio standard compliance account or be transferred to another REC tracking system.

The certification is binding for the entire project life, which can create significant long-term regulatory risk. Projects that elect this exemption and later take a state subsidy are banned from participating in the capacity market for the next 20 years (called the asset life ban) and lose all capacity revenue going forward.

Additionally, a renewable resource taking this exemption cannot partition the project to sell some of its RECs to voluntary buyers and some to a compliance buyer. Given that many of these renewable projects are too large for a single offtaker, demand for voluntary buyers may increase to contend with this requirement.

Based on conversations with developers exploring the competitive exemption pathway, the asset life ban risk is raising PPA prices by ~$0.50/MWh. This price increase is due to developers assuming no capacity revenue to the project in the years after the initial voluntary buyer PPA.

Resource-Specific Exemption (also called Unit-Specific Exemption)

Projects taking state subsidies can apply for this exemption by justifying a unit-specific MOPR floor price based on the specific attributes of the project, such as actual project costs, asset life, etc. This exemption would allow projects to bid a lower offer floor price in the capacity auction, giving them a greater chance of clearing the auction. Once a project clears the first auction with a unit-specific price, it will clear future auctions as an existing resource, guaranteeing capacity revenue for the remainder of the project.

This pathway has a higher burden of proof to justify the unit-specific MOPR floor price but lower long-term regulatory risk. Many developers are exploring this option given the regulatory risk under the competitive exemption and ability to monetize the project RECs. At the time of this publication, developers were revisiting their financial models to provide updated PPA pricing to Edison Energy.

What’s Next?

Edison Energy can help clients evaluate PJM projects and assist with contracting around this regulatory uncertainty in PJM. If you’d like to learn more about FERC’s Order on PJM MOPR, please reach out to Shannon.Weigel@EdisonEnergy.com for our policy brief.