Market Reports

The Altenex Market Report – Spring 2017: ERCOT Market Overview

The report is authored by the Edison Energy Supply Team: Emily Williams, Director of Supply; Mary Kate Francis, Energy Supply Associate; and Charley Hildt, Energy Supply Analyst.

This article is adapted from the Altenex Market Report – Spring 2017, a comprehensive assessment of the policy, technology, and pricing developments shaping the North American renewable energy market.

About ERCOT: The Electric Reliability Council of Texas (ERCOT) coordinates the movement of electricity for 90 percent of the state’s electric load. The state has had retail customer choice since 2002 and a nodal market since 2010. Texas’ world-class wind resource, robust transmission infrastructure, and liquid wholesale market has solidified ERCOT as the strongest market in the U.S. for new wind development. Solar prices in ERCOT continue to fall, but are still priced at a premium to wind projects.

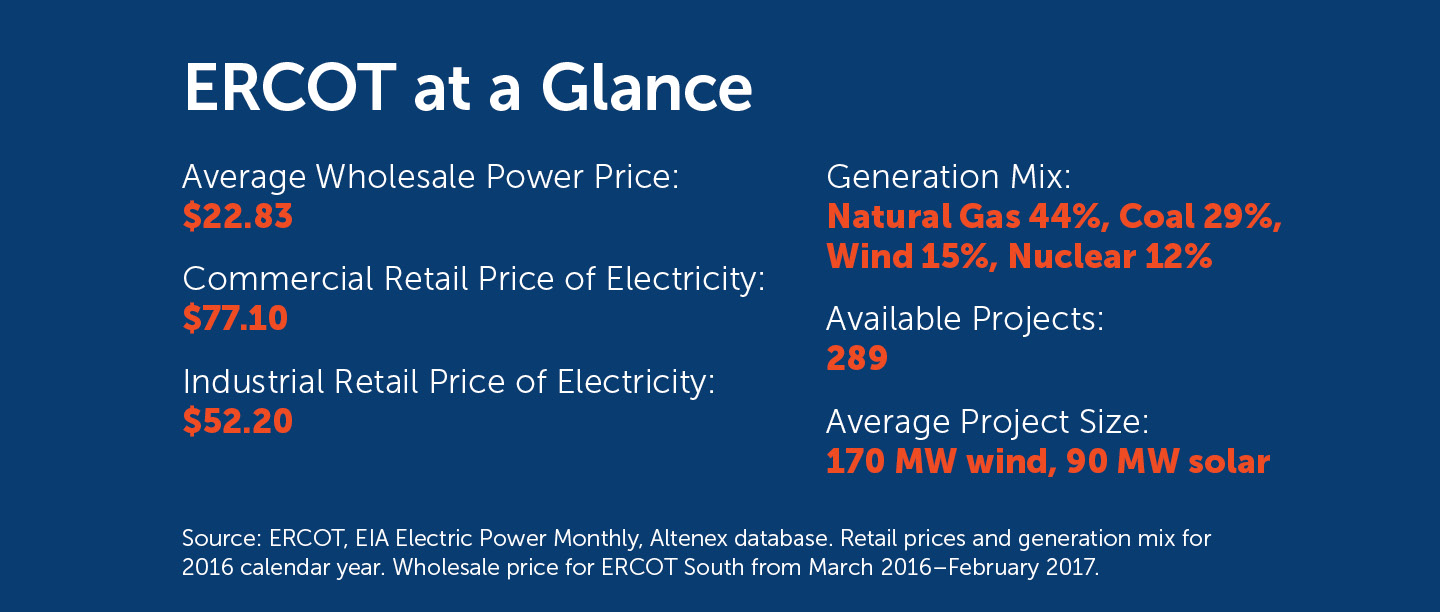

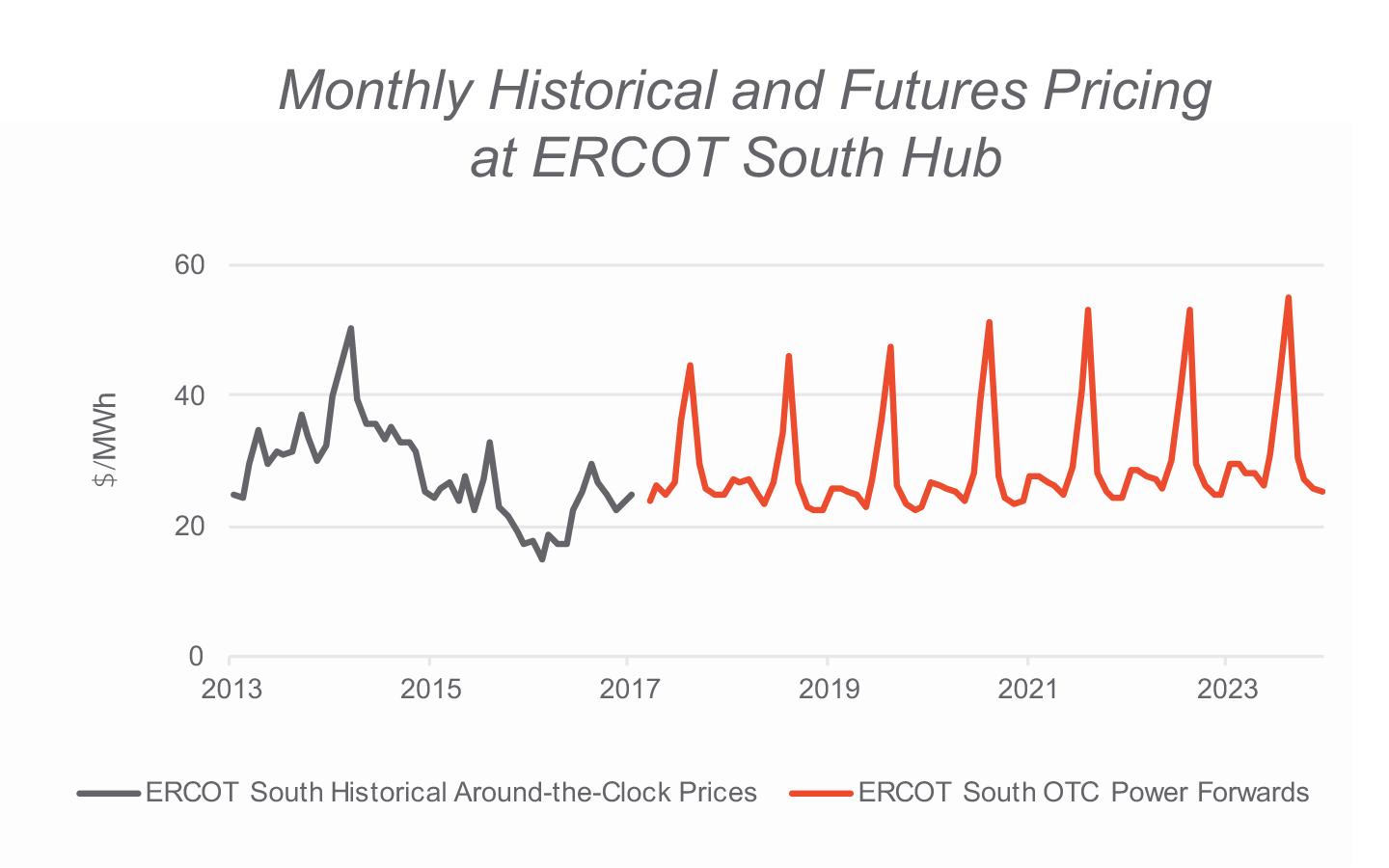

Wholesale power prices averaged $22.83/MWh in the past twelve months for real-time around-the-clock (ATC) pricing at ERCOT South Hub, a major trading point for electricity in the state. In 2017, wholesale prices are expected to average $28.45/MWh, based on a combination of early 2017 prices and OTC power forwards, as of late March 2017. The Figure below shows that power prices have rebounded since their record low in the winter of 2016.

In the next several years, forecasters expect prices to rise moderately, but remain below 2014 levels. The top driver is increased demand, spurred by population shifts from the Northeast to the Sunbelt, a high household formation rate in Texas, and expanding commercial and industrial sectors. Texas’ weak energy efficiency policy and limited net-metered solar power will do little to temper the growing demand. However, low natural gas prices and the growing penetration of low-cost renewable power on the ERCOT grid will keep pressure on prices.

Wind power is changing market dynamics in ERCOT. Last year, wind provided 15 percent of the generation mix, and March 2017 saw a record wind penetration level – hitting 50 percent during an early morning hour. With wind’s penetration growing, and low priced natural gas on the margin, coal and nuclear power are struggling to compete. In 2016, El Paso Electric became the first Texas electric utility to go coal-free and CPS Energy, the municipal utility for San Antonio, is shuttering two coal plants in 2018. As low-cost, variable, renewable power takes on a growing role in ERCOT, regulators are discussing and debating how the market will need to adapt.

What are the advantages of signing a deal in ERCOT?

[Available only in the full report.]

What are the challenges of signing a deal in ERCOT?

[Available only in the full report.]

The report is available to Edison Energy clients and to select commercial, industrial and institutional entities, jointly referenced here as C&I buyers. To request a copy of the report, please contact Christen Blum, Edison Energy, at Christen.Blum@EdisonEnergy.com