September 12, 2022

Win-win: Hydrogen, battery storage get major boost in IRA

By Mackenzie Kuran, Associate Project Engineer; Matt Donath, Senior Policy Analyst; Kyle Manahan, Senior Manager of Energy Storage; and Jeff Bolyard, Principal Energy Supply Advisor

Part 4: Breaking it Down – A Deep Dive into the Inflation Reduction Act

Stay in the know with Edison Energy’s Pulse on Policy series, a biweekly publication covering the latest in global legislation and regulation that impact corporate procurement plans and sustainability goals.

The previous installment of the Pulse on Policy series broke down the impact that the extension of the tax credits in the Inflation Reduction Act (IRA) will have on renewable deployment in the United States. Not only does the IRA extend the production credit (PTC) and investment tax credit (ITC) for clean energy, but the new law also makes standalone energy storage technology eligible for the Section 48 ITC and adds a new Section 45V PTC for hydrogen. The new energy storage ITC is available to both battery and hydrogen storage, with the credits available to standalone projects and those co-sited with renewable energy.

Kyle Manahan, Edison Energy’s Senior Manager of Energy Storage, and Jeff Bolyard, Principal Energy Supply Advisor, provide insights into the effects the new tax credits will have on each of these emerging markets.

Importance of Energy Storage to the U.S. Grid

Energy storage plays a critical role in the resiliency of the grid and reliability of renewable energy systems, as they rely on inherently intermittent resources. Energy storage systems, like batteries, stabilize the output of energy from a renewable energy system, making it possible to conserve energy for use during peak hours or provide backup power during grid disruptions. Storing energy during times of high generation and low demand cuts down on the amount of energy wasted, making the overall system more energy efficient.

Similarly, hydrogen can be produced from excess energy during periods of low demand from renewables like wind and solar, or projects might be designed to produce hydrogen at a more consistent rate from more firm sources such as nuclear. Hydrogen can then be stored in a variety of mediums, such as in fuels cells for re-electrification or in tanks as a liquid or gas for energy production or thermal processes.

The stored hydrogen can then be used at a later time to produce energy or used in other industrial processes, helping to address peak demand, similar to batteries. Hydrogen has the added benefit of being able to be stored for long periods of time and potentially used for longer duration than battery counterparts.

Energy Storage ITC

The new energy storage ITC is available to both battery and hydrogen storage beginning in 2023, with the credits available to standalone projects and those co-sited with renewables. To qualify for ITC credits, an energy storage system must receive, store, and deliver energy, or in the case of hydrogen, stores energy, for conversion to electricity and have a capacity that is not less than 5 kWh.

The ITC credit values match those from the other clean energy ITCs – a base credit of 6% that increases to 30% if labor requirements are met, and stackable bonus adders for 10% for domestic content and 10% for projects located in an energy community. If the project is less than 1MW AC, it would automatically qualify at the 30% ITC value. Like the ITC for clean energy projects, storage projects are eligible for the ITC until 2025, when the credit transitions to a technology-neutral credit that will phase down through the end of 2035.

IRA Impact on U.S. Storage Market

The passage of the IRA is expected to make energy storage technology more accessible for project developers and grid operators. In turn, this will increase grid resilience and reliability, making it possible to incorporate more renewable energy onto the grid while still providing uninterrupted power to consumers. The tax credits will further incentivize businesses to install behind-the-meter storage as a means to capture energy bill savings (demand charge reduction and energy arbitrage) and have backup power during grid disruptions.

According to Kyle Manahan, Edison’s Senior Manager of Energy Storage, “Standalone battery storage is likely to see an even more significant impact than other renewables because it did not previously benefit from the ITC. This ITC is expected to strengthen the financial attractiveness of battery storage at commercial and industrial facilities in the mid term.”

The inclusion of tax credits for energy storage has the potential to bring storage projects up to par with other renewable energy technologies, which have benefited from tax credits for over a decade. Unfortunately, due to supply chain constraints for battery components, such as critical minerals, it will likely take several years before the market feels the full effects of the new law.

“While we expect the energy market to experience immediate benefits of the IRA, these benefits will be muted for the battery storage industry,” said Manahan. “This is due to the industry facing increasing supply chain constraints, brought on by surging EV battery demand and equipment delays, as over 80% of battery cell supply is in China. These factors are raising installation costs and pushing out operation dates for corporate offtakers.”

The IRA aims to address these issues through several other provisions that will strengthen domestic production of batteries and incentivize the shift in the supply chain to the U.S. and its allies. New tax credits for production of clean energy components including batteries and critical minerals, along with domestic content requirements in clean energy and EV tax credits, stand to play a major role in driving investment in U.S. manufacturing. While this will take time, the combination of the storage ITC and a strong domestic supply chain should continue to drive down storage costs and equipment lead times in the mid to long term.

Clean Hydrogen PTC

In addition to hydrogen storage facilities qualifying for tax credits, clean hydrogen production facilities are now eligible for tax credits under the new Section 45V PTC. The credit is available to hydrogen production facilities that begin construction prior to 2033, with facilities eligible for 10 years after completion of the project.

The credit amount is determined by the lifecycle emissions of the produced hydrogen. To be eligible for any credit, the emissions must be 4 kgs of carbon dioxide equivalent (CO2e) or less per kg of hydrogen. Under this requirement, only hydrogen produced from renewable energy (green hydrogen), nuclear energy (pink hydrogen), or produced from natural gas facilities with carbon capture (blue hydrogen) would qualify for credit.

Jeff Bolyard, Principal Energy Supply Advisor, adds, “The full rainbow of hydrogen colors – from green, to blue, to pink – are all receiving stimulus from the IRA in different forms that should allow each to prove out the economics and overall benefits of each technology in the short and long term, encouraging collaboration and private investment rather than choosing winners and losers as energy policy has done in the past.”

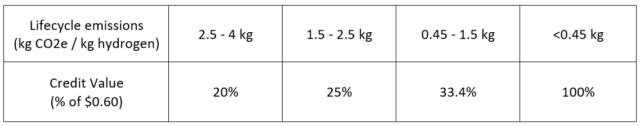

As the emissions per kg decrease, the credit value increases, which highly incentivizes production of green and pink hydrogen from zero-emission sources. The full credit value available for hydrogen from clean sources is $0.60 per kg produced, with a percentage being applied to the credit for hydrogen with higher emissions, as shown in the table below.

Like other credits under the IRA, the hydrogen PTC also includes a potential 500% increase in credit value if prevailing wage and apprenticeship requirements are met, along with 10% bonus adders for domestic content and location of the facilities in an energy community.1 This puts the full value of the credit to $3.00 per kg, with potential stackable bonuses to $3.60 per kg.

Like other credits under the IRA, the hydrogen PTC also includes a potential 500% increase in credit value if prevailing wage and apprenticeship requirements are met, along with 10% bonus adders for domestic content and location of the facilities in an energy community.1 This puts the full value of the credit to $3.00 per kg, with potential stackable bonuses to $3.60 per kg.

This new credit also has the added benefit of being eligible for direct pay for any U.S. public, private, or nonprofit entity, meaning that the credits can be paid directly to the project owner regardless of tax burden.

The hydrogen provisions in the IRA are somewhat unique in that there are multiple opportunities for the credit programs to cross over with others under the new law. Hydrogen production can be co-sited with renewable energy, nuclear, storage, and carbon capture, all of which have their own credit available under new or expanded programs. Of these four potential co-located resources, only carbon capture + hydrogen projects are ineligible to take advantage of both program credits and will need to elect one or the other.

IIJA and IRA Impact on U.S. Hydrogen Market

In late 2021, the Infrastructure Investment and Jobs Act (IIJA) provided the Department of Energy (DOE) with $8 billion in funding to support research and demonstration of hydrogen projects across the country called Hydrogen Hubs, with the ultimate goal of reducing the cost of green hydrogen to $1 per kilogram. These projects are meant to demonstrate varying feedstocks and end uses for hydrogen in different regions of the country, including stipulations that regions with existing natural gas infrastructure are considered for at least one of the hubs.

While the locations of these hydrogen hubs are yet to be announced, the promise of connecting suppliers with potential users while supporting the necessary infrastructure has already begun to jumpstart the market, according to Bolyard.

“The DOE’s $8 billion in funding for the development of regional hubs with the stipulation that one of them be in a natural gas – producing region sets the hydrogen train in motion,” he said. “This will allow the best possible outcome to occur long term by offering an olive branch to the natural gas industry that has the pipeline and storage expertise today that will be needed to efficiently develop a domestic hydrogen market tomorrow. The IRA incentives to the hydrogen market has spurred collaboration and private investment across traditional fossil fuels and the emerging market of hydrogen rather than just the penalties and deterrents that have hindered its progress in the past.”

The $3.00 per kg tax credit included in the IRA stands to jumpstart green hydrogen from an emerging technology to a major player in the energy transition. Early analysis shows that the IRA will make U.S. – produced green hydrogen the cheapest in the world. In some areas of the U.S., the credit for green hydrogen production will lower the price enough to be cost-competitive with grey hydrogen, which is produced from methane reformation and has a much higher emissions footprint.

This could lead to opportunities for early adopters of hydrogen, such as heavy industries and industrial companies with decarbonization goals, to switch to green hydrogen and see comparable costs – if not savings – in some markets. Bolyard notes that this prospect is already beginning to change outlooks among industry participants.

“The potential provided by the IRA and the IIJA to develop a green hydrogen market, which begins with a plan for competitive production of H2, combines it with lower cost infrastructure, and ultimately connects it to end use markets, is immeasurable,” he said. “Even hard-to-abate industrial sectors are now believing there is hope for an alternative.”

As other provisions in the IRA that aim to lower costs of hydrogen – producing equipment such as electrolyzers are fully implemented and expand the buildout of renewable energy, the price of green hydrogen should continue to drop in the long term. These landmark federal policies stand to transform the clean hydrogen market and reach towards the federal goal of $1 per kg by the end of the decade.

1 For example, hydrogen produced from a facility with lifecycle emissions 2 kg CO2e/ kg H2

- $0.60 base credit x 25% emissions value = $0.15 / kg H2

- With prevailing wage and apprenticeship bonus: $0.15 x 5 = $0.75/ kg H2

- With domestic content 10% = $0.825/ kg H2 total credit value

Stay tuned for the next installments of our Pulse on Policy series, where we will dive deeper into the climate provisions in the IRA and share our insights on how these policy changes may impact companies’ energy and sustainability strategies.

Join Our Mailing List

Supply Chain Decarbonization: Your Guide is Here!

Download our new white paper on establishing a successful decarbonization program.

Read More