March 7, 2023

The Rig Counts Provide Insight into Future Natural Gas Production

By Jeff Bolyard, Principal, Energy Supply Advisory

This post by Jeff Bolyard, Principal, Energy Supply Advisory, will be featured in our March 2023 Monthly Monitor, which includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets. To read the full newsletter, click here. To sign up for the Monthly Monitor distribution list, click here.

Each week, the Energy Information Administration (EIA) puts out a natural gas storage report. The gas market anxiously awaits the reality check that measures the supply/demand balance that is measured by the level of injection or withdrawal into or out of storage, then compares that accumulated balance against the same week in prior years.

Forward market pricing reacts, often in extreme spikes or dips, based on the perception that production is either capable – or not – of meeting demand. Most of the time, the price impact of the storage report is limited to a forward period of one to seven months due to the seasonal need to use or fill storage, which flips every summer and winter.

However, what if one wanted to go beyond the short term and try and gain insight into the supply/demand balance beyond the next summer or winter season? One of the tools we can use that gauges the potential on the production side is the weekly Drilling Rig Count.

Rig counts measure the number of active drilling rigs searching for either crude oil or natural gas. Natural gas traders care deeply about both, as crude oil-based plays produce significant amounts of associated natural gas as a byproduct of crude oil production. While natural gas pricing and supply benefit greatly from associated gas from oil wells, the investment decision in that region is driven not by gas prices, but crude oil prices.

Major crude oil-producing plays like the Permian and Eagle Ford shale plays in west and south Texas combined to produce an estimated 29.1% of natural gas production in the lower 48, while the two largest natural gas shale regions of Appalachia and Haynesville (east Texas & western Louisiana) combined to produce an estimated 52% of traditional methane supplies in the lower 48 in February 2023. As such, both oil and natural gas-focused production investment play a critical role in maintaining or growing natural gas production into the foreseeable future because both contribute significantly to the overall supply of natural gas.

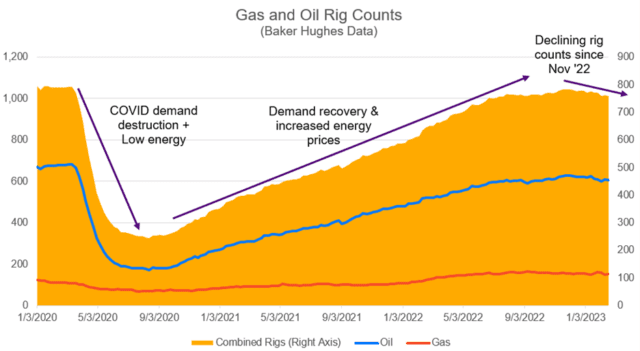

The chart below shows a recent history of the number of rigs searching for either natural gas or crude oil. After falling significantly in the first half of 2020 due to Covid demand destruction and low energy prices, rig counts steadily climbed for 25 months, peaking in mid-November 2022 at 784 rigs before stalling and declining by 24 over the last three months to 760.

Since it typically takes 6-12 months for a drilled well to get gas or oil to start producing once it is connected to the market, the number of drilling rigs, the type of commodity being drilled for, the region the rig is located in, and the futures price of gas and/or crude oil and hydrocarbons (propane, butane, ethane, etc.) all play into what and where producers are choosing to invest in future production and how much production might be coming from each of those regions.

Keep in mind that anything related to the supply side of the equation, including rig counts, only accounts for a portion of the energy complex. The expansion or contraction of the demand side of the balance also plays an enormous role as well. The directional trend of drilling rig counts provides some insight as to the investment being made into future production, which needs to be balanced with the expectation of future demand. If we assume demand for natural gas – including LNG exports and gas-fired power generation – is going to increase, then more gas and oil drilling rigs will be needed for increased production in 6-12 months to meet that demand.

While the downward trend in the rig count is not the direction buyers would like to see, it is only one of several indicators. What we can logically speculate is that if the number of drilling rigs searching for natural gas and oil continues to decline, future production increases will not occur. Many analysts predict that the typical decline of production from legacy wells will outpace production from new wells if increased rigs don’t materialize and depleted drilled but uncompleted (DUC) well numbers (a future blog topic) aren’t replenished.

Edison Energy will keep watching the rig count trend, along with many other drivers of the natural gas price, to try and provide insight to the direction of energy in the future.

Contact Edison Energy today to learn more!

Join Our Mailing List

Download our March 2023 Monthly Monitor

A newsletter that includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets.

Learn More