February 9, 2023

The February 2023 NYMEX Natural Gas Roller Coaster

By Jeff Bolyard, Principal, Energy Supply Advisory

This post by Jeff Bolyard, Principal, Energy Supply Advisory, is featured in our February 2023 Monthly Monitor, which includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets. To read the full newsletter, click here. To sign up for the Monthly Monitor distribution list, click here.

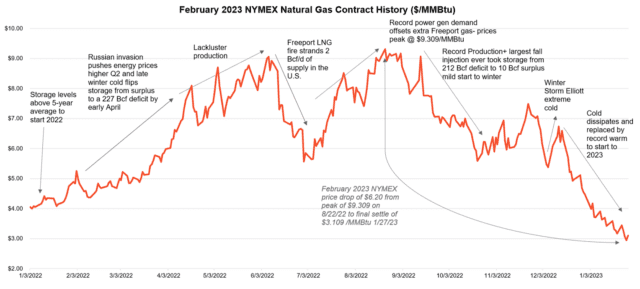

The February 2023 natural gas NYMEX contract came to a final settlement on 1/27 at a price of $3.109/MMBtu – slightly less than 50% of the final settlement in February 2022 and the lowest monthly settlement of any month since July 2021.

The chart below tracks the price of that contract over the past year and highlights eight unrelated factors that impacted the February 2023 NYMEX contract price over that stretch. This set into motion a roller coaster ride of pricing that only thrill seekers or those with high anxiety thresholds would enjoy.

It all began in 2022, when storage levels were at a surplus compared to the 5-year average. This inventory surplus quickly changed to a deficit due to a late winter cold spell, followed by the upheaval of the entire energy landscape with Russia’s invasion of Ukraine.

Prices continued to rise in Q2 in correlation to sluggish production growth. Then, on June 8, 2022, a fire at the Freeport LNG facility took the 2 Bcf/day facility offline and stranded gas destined for export for use in domestic markets, causing prices to tumble. In July and August, record power generation demand for natural gas fully utilized this extra gas, pushing prices back up to the peak price for futures contract on 8/22 of $9.309/MMBtu.

From there, it took record production, the largest autumn storage injection, and the continued delayed reopening of Freeport to flip a dire 202 Bcf storage deficit to a 10 Bcf surplus just before winter arrived. A short but very cold spurt around Christmas from Winter Storm Elliot spurred a brief spike to pricing but was quickly reversed once the reality of extremely mild weather hit as the calendar flipped to 2023.

The warmest January in over a decade and the first-ever injection into storage in January dramatically changed the outlook. Suddenly, what could have been a sketchy second half of winter beleaguered by significantly higher prices throughout the summer injection period ultimately turned into a second consecutive month of giving – this time in the form of low natural gas prices.

For 2023, market expectations are mixed when it comes to pricing. A majority of forecasts project opportunistic buying during the first half of the year, as supply appears adequate to meet demand with an increased risk of higher prices as the year progresses and international demand recovery grows.

However, nearly everyone believes this to be a temporary price reprieve limited to this year, with 5.7 Bcf/day of LNG exports planned between 2024-2026, along with producers’ steadfast commitment to reduce debt, reward stockholders, and not return to the “win big or lose big” mentality of old.

Unless buyers can anticipate the next extreme weather or geopolitical event or are willing to live with ongoing uncertainty in the new energy landscape, they should consider current price opportunities for the rest of 2023, as well as for 2024 and beyond, to mitigate price risk and volatility.

Contact Edison Energy today to learn more!

Join Our Mailing List

Download our February 2023 Monthly Monitor

A newsletter that includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets.

Learn More