August 20, 2021

New Jersey Solar Successor Program: SuSI

By Connor Kasch, Policy and Commercial Intern

New Jersey Approves the Successor Solar Incentive Program, SuSI, Doubling the Solar Capacity of State by 2026

What you need to know about the previous New Jersey Solar Program

New Jersey has one of the strongest onsite and distributed generation solar markets in the United States due to its ambitious Renewable Portfolio Standard (RPS) of 50% by 2030. The New Jersey RPS includes a 5.1% solar carve-out. This carve-out creates valuable Solar Renewable Energy Credits or “SRECs,” which represent 1 MWh of energy produced by a solar project. Owners of solar projects in the state receive a corresponding number of SRECs for the electricity they produce, and then can sell these SRECs to investor-owned utilities in New Jersey who must obtain a certain amount of SRECs meet the RPS requirement. New Jersey has already gone through several adaptations of the original SREC program. SuSI is the most recent evolution of this program.

What is SuSI?

“SuSI,” replaces the previous Transition Renewable Energy Certificate (TREC) program created by the New Jersey Board of Public Utilities (NJBPU). Approved at the end of July, SuSI will go into effect on August 28 and is the culmination of a lengthy, deliberative process. Three years ago, the NJBPU was tasked with devising a new incentive program to provide continued support for the expansion of solar energy in the state. In the interim period, TRECs were used as the transitionary incentive. Now, the approval of SuSI has introduced changes to the program to recalibrate the price of SRECs to minimize ratepayer costs. As solar has become cheaper, there is reduced need to have highly priced SRECs to attract project developers to the state or incentivize homeowners to install rooftop solar arrays. Despite the reduction in SREC values, NJBPU believes SuSI is aligned with Governor Phil Murphy’s vision for clean energy and the state’s goal of 100% clean energy by 2050.

Key Details of SuSI

SuSI is a hybrid incentive program with a tailored design to promote desirable projects where there is the most need. With SuSI, the NJBPU wishes to strike a balance between market stability – something the SREC market has struggled with in the past – and flexibility to adapt to the dynamic landscape of solar project development.

The two sub-programs that comprise SuSI are the Administratively Determined Incentive (ADI) and the Competitive Solar Incentive (CSI). Net metered projects with less than 5 MW of capacity, meaning all residential customers and even most commercial/industrial customers, can take part in the ADI sub-program. SREC-II values have been reduced to $70 – $120/MWh from a previous value of $220, but the incentive value is guaranteed for 15 years and is still quite attractive.1 The ADI program is administered through 150 MW annual blocks and allocated on a first-come, first serve basis until fully subscribed. The CSI program differs significantly from the ADI program in that it uses a competitive solicitation process to minimize costs and pass savings along to the ratepayers. The NJBPU plans to release additional details on how the bidding process will be run. The program is expected to be launched by mid next year.

| SuSI By the Numbers |

|

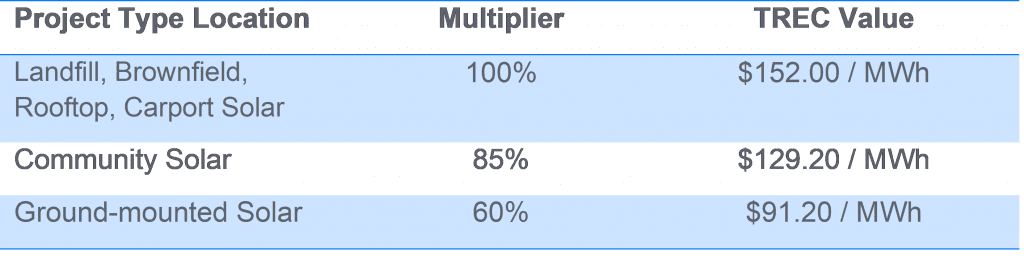

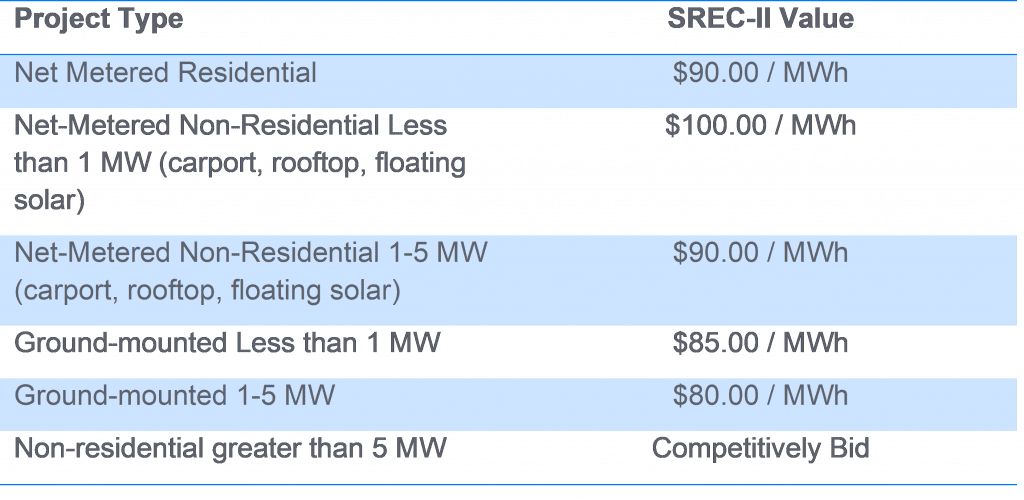

TREC vs SuSI: Incentive Values

The previous iteration of SRECs, TRECs, was not a hybrid program. Instead, it relied on a tiered system that ranked projects by type and location. The introduction of SuSI will not affect projects already enrolled in the TREC program. Notably, projects can only be enrolled in one program at a time. This means that project owners currently taking part in the TREC program but would like to move to the ADI program must cancel their participation in TREC before registering for ADI.

TRECS2

- TREC values are fixed for 15 years.

- Values of TRECs are dependent on project location and the energy user.

SREC-II3

- The fixed values will be reviewed and reset by the NJBPU every 3 years.

- Under SuSI, public entities such as school districts, municipalities and public higher education institutions will receive an additional $20/MWh on top of the SREC-II value.

Anticipated Impacts on Distributed Solar Projects

Edison Energy expects SuSI will continue to drive solar energy expansion in New Jersey, as solar developers and generators can expect a predictable revenue stream from selling SREC-II’s in this lucrative market. With revenue stream from SRECs, solar developers can significantly reduce PPA rates for commercial and industrial buyers below utility supply rates.

The monetization of project SRECs generally results in more competitive Power Purchase Agreement rates relative to retail electricity rates. For direct ownership, the monetization of project SRECs lowers the upfront cost to install a system. However, the monetization of project SRECs limits a buyer’s environmental claims related to Scope 2 greenhouse gas emissions reductions. If an entity needs a stronger sustainability claim, Edison Energy can help with contracts for “replacement RECs” with the project’s developer. Replacement RECs are low-cost national RECs (currently trading at $6.25 – $6.50) that allow buyers to substantiate renewable energy use and carbon reduction claims.4

Considering onsite solar or a solar PPA in New Jersey? Reach out to the Edison Energy team to learn more.

[1] Board of Public Utilities | NJBPU Approves 3,750 MW Successor Solar Incentive Program

[2] Board of Public Utilities | Newsroom & Public Notices

[3] Board of Public Utilities | NJBPU Approves 3,750 MW Successor Solar Incentive Program

[4] Renewable Energy Certificate (REC) Arbitrage | US EPA