March 9, 2022

It’s Complicated: New Variables Impacting the Natural Gas Markets

By Jeff Bolyard, Senior Director, Commodity Strategy

This post by Jeff Bolyard, Senior Director, Commodity Strategy, is featured in our recently released March 2022 Monthly Monitor, which includes articles and analysis for the natural gas, electric, crude oil, and sustainability markets. To read the full newsletter, click here. To sign up for the Monthly Monitor distribution list, click here.

As the Russian invasion of Ukraine continues to unfold, our thoughts and prayers are with the Ukrainian people. While we have yet to understand the full impact of the conflict, we do know that there have already been ramifications that have reached well beyond the borders of those countries and the region.

While the price of energy pales in comparison to the greater concern for the Ukrainian people around the world, the impact of this invasion does indeed impact the price of energy across the globe. Over the last 8-10 years, many European countries have increasingly relied on Russian natural gas and oil to supply the demand of the region. It is estimated that between 30-40% of energy into western Europe is provided by Russia. Thus, when there is potential disruption of energy supply, supply and demand balances are impeded, market concerns grow, and price volatility occurs.

On February 23, Brent crude traded at $97.68/barrel. By March 7, the price rose 17.3% and was trading at over $114. The TTF natural gas April 2022 contract in Europe was trading at $93.14 on 2/24. It is now $121.67–a 30.5% rise.

In the U.S., WTI crude has followed a similar rising trend to Brent, but natural gas pricing has not seen the same impact. Unlike Europe, the U.S. exports a significantly higher percentage of oil production than gas. The U.S. also produces more natural gas than it consumes, leaving excess to be exported to other regions across the world. The result of this major difference is that oil prices trend closer to international pricing, while natural gas prices have detached.

Based on that single data point, one might assume that there should be little to worry about regarding rising natural gas prices long term. But before we bet the farm on that concept, let’s look at just one of several variables that could change the supply/demand balance in the U.S. over the next six years. That variable is coal-fired power generation retirements.

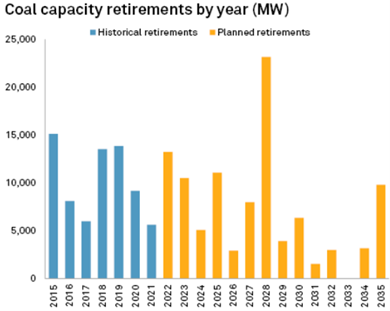

According to the EPA’s Effluent Limitation Guidelines, which regulate coal ash and toxic metals in wastewater, generators that do not meet the requirement were given an extension to comply until Dec. 31, 2028–if they agreed to retire their plants by that date. The S&P Platts chart above shows the planned coal retirements by year that total 51 GW from 2022-2027 and peaking in 2028, with over 23,000 MW to be shuttered in that year.

Renewable generation will see significant growth into the foreseeable future as we transition to a greener energy market. However, until the bridge to a cleaner world can be built, traditional fuels like natural gas and nuclear will not only be needed but will see growth–especially in states or regions that are still reluctant to embrace the renewables transition. Should that occur, natural gas pricing could rise and experience volatility.

Join Our Mailing List

Supply Chain Decarbonization: Your Guide is Here!

Download our new white paper on establishing a successful decarbonization program.

Read More