August 25, 2022

IRA Tax Provisions Prove Promising for the Renewables Sector

By Shannon Weigel, Head of Policy; Grace Morrissey, Clean Energy Manager; and Pat Mingey, Senior Clean Energy Analyst

Part 3: Breaking it Down – A Deep Dive into the Inflation Reduction Act

Stay in the know with Edison Energy’s Pulse on Policy series, a biweekly publication covering the latest in global legislation and regulation that impact corporate procurement plans and sustainability goals.

One of the big energy sector winners in the Inflation Reduction Act was the renewables industry. But what does the IRA mean for renewable energy buyers? As highlighted in our introductory blog post, the IRA bolsters the private sector’s efforts towards their climate commitments and reduction of Scope 2 greenhouse gas emissions by extending the renewable tax credits over a 10-year period.

Grace Morrissey, Clean Energy Manager and Pat Mingey, Senior Clean Energy Analyst, share some insights into how the IRA will impact renewable energy buyers, as well as Edison Energy’s efforts already underway to get greater clarity from the development community during this transition from law to implementation.

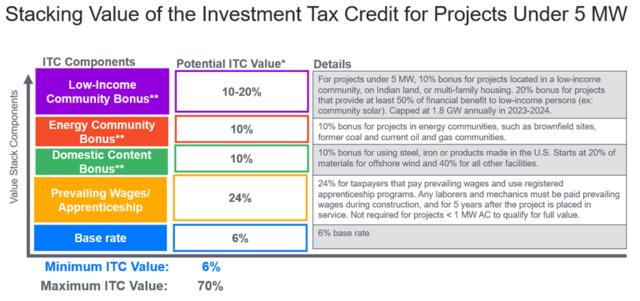

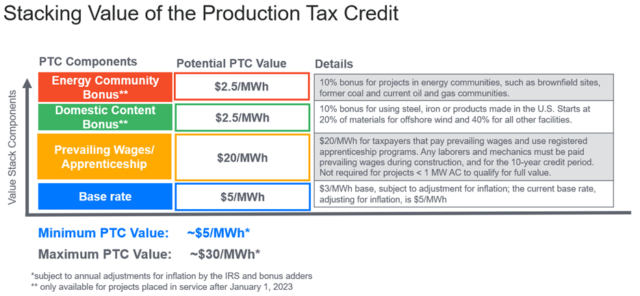

Renewable Energy Tax Credits

The IRA extends both the production tax credit (PTC) and investment tax credit (ITC) for clean energy projects placed in service between 2021-2024 and then transitions to a technology-neutral tax credit from 2025-2035. Because of the emissions profile of wind and solar, the tax credit value remains unchanged after the transition. Clean energy projects can achieve tax credit rates higher than the current market allows by meeting requirements for bonus adders. These bonus adders are intended to incentivize developers to pay prevailing wages, create jobs through apprenticeships, and develop projects in communities that have been disproportionately impacted by emissions and climate change.

*Percentage of total project costs

** only available for projects placed in service after January 1, 2023

The range of ITC value a project can qualify for under the IRA is 6-50% for utility-scale projects, reaching up to 70% for projects under 5 MW, compared to 26% under current law.

The range of PTC value a project can qualify for is approximately $5-30/MWh compared to the $26/MWh PTC today.

Behind-the-meter and smaller community solar will see an immediate impact driven by the ITC increase up to 30%, if prevailing wage is met. Projects less than 5 MW can now include interconnection costs as part of the total amount eligible under the ITC, reducing prices passed to offtakers due to rising utility interconnection costs that have increased in recent years as the grid becomes more constrained. These changes will expand the number of states where behind-the-meter solar will have an economic benefit.

In the short term, offsite wind and solar projects will see the biggest benefit from the PTC going back to full value. With the new possibility of solar projects selecting the PTC rather than the ITC, developers are exploring the economic impacts of switching solar investments to the PTC and anticipate it will make economic sense in high solar resource areas like Texas, California, and the Southwest, while continuing to elect the ITC as the standard approach in other areas.

It is anticipated that the solar PTC will drive significant changes in wholesale market dynamics, especially with regard to negative pricing. If many projects in high solar resource areas elect the PTC, more negative wholesale market pricing is expected. Utility-scale solar projects electing the ITC will benefit from the 26% to 30% increase – and potentially up to 40% – if U.S. manufacturing thresholds are met, though some of the benefit will be eroded by the additional cost of sourcing U.S. products until the domestic supply chain is developed to meet the demand.

The supply and demand imbalance for offsite projects will still exist in the near term, which will keep prices elevated. As the U.S. supply chain expands and project developers can increase their pipeline with a focus on siting projects where the largest ITC value will be captured, PPA prices will likely start to come back down. This could take three to five years to be fully realized.

Though it will take some time for the industry to unpack the law and its impacts on renewable asset development, developers are sharing positive initial reactions given the IRA’s inherent long-term growth potential for the utility-scale clean energy business. As there are still many outstanding questions regarding implementation and impacts, the Edison Energy team continues to actively gauge developers’ responses to the law as this information becomes available.

From initial discussions, developers have confirmed this legislation is a positive signal to launch, expand, and diversify business lines in the clean energy space, including battery storage, hydrogen, and distributed solar. Given the increase in expected renewables buildout, the market anticipates significant changes to wholesale market dynamics, specifically with regard to congestion and basis risk. To assess these changes, third-party forecasters are in a rush to update models to reflect IRA-driven utility-scale renewables growth. From an offtaker or financier perspective, the next iteration of long-term electricity forecasts will be telling as far as what the market has in store.

Developers are still in the early stages of analyzing how the new PTC and ITC provisions will affect pricing. Developers are grappling with many unknowns. For example, could the increased costs associated with domestic procurement of materials plus adhering to new prevailing wage and apprenticeship requirements outweigh the cost savings associated with the tax credits? Specific guidance from the Treasury Department around wage and apprenticeship requirements has yet to be released. As developers gradually factor in the multitude of changes and opportunities that the IRA presents, prices are sure to adjust, but to what degree remains unclear in the short term.

Stay tuned for the next installment of our Pulse on Policy series, where we will dive deeper into the IRA’s climate provisions surrounding energy storage tax credits.

Join Our Mailing List

Supply Chain Decarbonization: Your Guide is Here!

Download our new white paper on establishing a successful decarbonization program.

Read More