October 14, 2022

Inflation Reduction Act and Biden Administration Push Commercial Energy Efficiency to a New Level

By Matt Donath, Senior Policy Analyst

Part 6: Breaking it Down – A Deep Dive into the Inflation Reduction Act

Stay in the know with Edison Energy’s Pulse on Policy series, a biweekly publication covering the latest in global legislation and regulation that impact corporate procurement plans and sustainability goals.

While much of the focus when covering the Inflation Reduction Act (IRA) has been centered on areas such as renewable energy generation – and rightfully so – other provisions that have significant potential to impact energy use and emissions in the built environment have flown under the radar. While the previous installation of Pulse on Policy looked at how the IRA benefits the industrial sector specifically, there are several provisions that target non-industrial commercial buildings.

In this week’s Pulse on Policy, Saverio Grosso, Managing Director of Advisory Demand, and Eric Koehler, Director of Retrofit Solutions, both on Edison Energy’s Energy Optimization team, provide insights into how building owners can plan for changes stemming from the IRA and take advantage of expanded programs to reduce costs while saving energy.

Updated Energy Codes

The IRA directs the Department of Energy (DOE) to funnel $1 billion through to states and local governments for the development and implementation of more advanced building energy codes. These energy codes set minimum efficiency standards for commercial buildings of all types and uses.

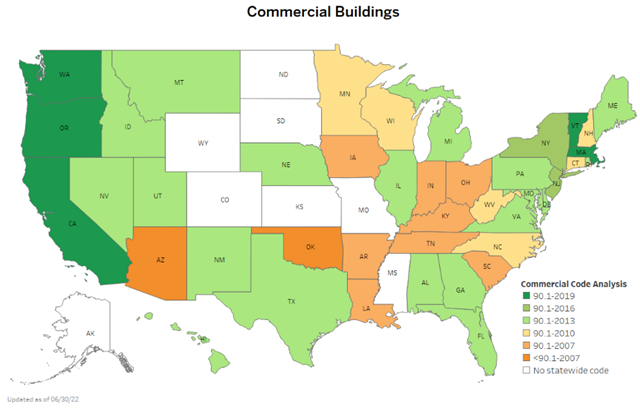

Organizations like the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) and the International Code Council develop model codes that can be adopted by governments and produce updates every three years. Generally, energy codes are adopted at the state level, but some states also allow local governments to set additional code requirements, or stretch codes. Because each state is able to adopt its own code, the level of efficiency varies dramatically across the country, with some states adopting the newest standards as they are released, while some are still operating on code developed prior to 2007.

Dept of Energy Status of Energy Code Adoption – 6/30/22

The IRA funding is available for governments who wish to pursue code that is at least equivalent to ASHRAE 90.1-2019 – the most recent energy code that only five states have adopted to date. States or major cities with the ability to increase their baseline code – from an outdated year to the most recent – have the potential to greatly lower the amount of wasted energy, with many seeing more than a 10% increase in efficiency, while others have seen an increase of more than 30%.

Over $600 million of these funds can also be used by state and local governments to develop and adopt building codes that meet or exceed the zero-energy code included in IECC 2021, setting commercial buildings on a path of net-zero energy usage.

Energy Efficient Commercial Building Tax Deduction

In a move designed to incentivize building owners to invest in more energy-efficient buildings, the IRA made substantial changes to the existing Section 179D Energy-Efficient Commercial Buildings Tax Deduction, which begins in 2023. This program allows for a tax deduction based on the energy efficiency of a commercial building when compared to a reference standard.

Prior to the IRA, commercial buildings were required to be 50% more efficient than the standard to qualify for a credit of $0.60-$1.80 per square foot. The new guidelines decrease the efficiency threshold to 25% beyond the relevant standard, which is the ASHRAE standard in effect from four years prior, thus increasing the potential payment on a sliding scale. If prevailing wage requirements are met, the credit begins at $2.50 per square foot for a 25% increase in efficiency. This is available for up to $5.00 per square foot for up to 50% increase in efficiency. These changes nearly triple the potential value of the credit while also decreasing the relevant standard, making the program much more accessible.

The IRA also adjusted eligibility requirements to receive the 179D credit. While commercial building owners are still eligible, non-taxable entities such as governments and nonprofit organizations can use the program and transfer the credit to designers of the property or projects, which can include architects, engineers, and energy service providers. This change allows for entities such as local governments, schools, and healthcare systems to take advantage of the program – even without tax liability.

To increase the value of the program even further, the new guidelines allow the credit to reset three years after deduction for commercial buildings and every four years for government buildings.

“I am hopeful that the expansion of the Energy Efficient Commercial Buildings Tax Deduction will encourage deeper energy efficiency efforts for both public and private sector building owners,” said Eric Koehler, Director of Edison Energy’s Retrofit Solutions. “In my experience, this tax deduction has been underutilized historically – many of my clients felt the administrative burden, or staff cost, of demonstrating the improvements outweighed the tax benefit. The increase in the incentive to $5.00 per square foot, combined with the three- or four-year reset of the incentives per building, could change the market and incentivize reluctant owners.”

National Building Performance Standard Coalition

The IRA’s attention to increasing energy efficiency mirrors earlier efforts by the Biden administration to place renewed focus on such a critical area. In early 2022, the Biden administration launched the National Building Performance Standards Coalition to align federal government resources with state and local governments to implement building performance standards across the country.

Building performance standards (BPS) are policies enacted at the state or local level that require buildings to reduce emissions or energy consumption over a given period. BPS go a step further than energy codes, whose impact are limited to new buildings or those undergoing major renovations, and instead target existing buildings and require annual reporting of energy or emissions metrics. If a building owner does not meet the annual compliance level, they may be fined until compliance is met.

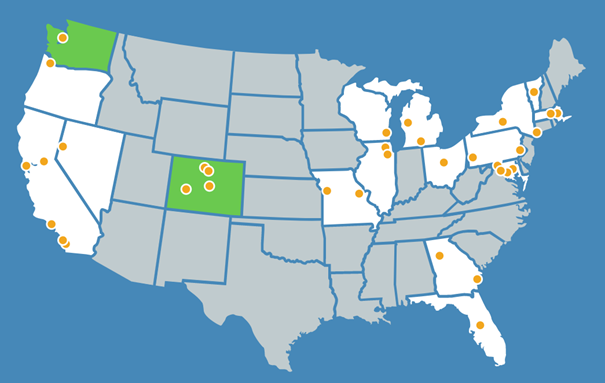

Because of their extended reach, BPS are seen as an extremely important policy tool to help reduce emissions from the built environment. This had led to the adoption of BPS in several major cities, such as New York, Boston, Denver, and Washington D.C., as well as the states of Maryland, Colorado, and Washington.

The National BPS Coalition aims to expand adoption by pulling together executive leadership from cities and states across the country. In total, over 40 cities and states have committed to working through the coalition, along with technical and policy support from the DOE, to share best practices, integrate stakeholder feedback, and develop BPS locally. The end goal is to reach adoption across the member governments by Earth Day, 2024.

National BPS Coalition Member Map

In existing BPS programs, such as New York City’s Local Law 97 and Boston’s BERDO 2.0, building owners can comply by achieving the required reduction targets, or via an alternative compliance pathway, such as financial payments. While building owners may view alternative compliance payments as an easier pathway to avoid further fines. However, if potential energy cost savings are considered, this may be shortsighted. Additional tools from the IRA, such as the 179D tax deduction, may further skew this calculation to the side of implementing energy efficiency projects to reach compliance.

“For many, achieving compliance with local legislation and mandates becomes the initial driver for the development of an energy reduction program,” said Saverio Grosso, Managing Director of Edison Energy’s Advisory Demand. “However, once these programs are underway, it becomes apparent that there are additional benefits beyond just attaining compliance – especially as the programs begin to expand. Assessing building operations as a first step allows owners to make an immediate impact while developing a baseline to improve upon going forward. Early success also builds momentum. With potential incentives available to assist with these first steps, it makes sense to focus on improving building systems first before looking at alternative pathways.”

Learn more about how Edison’s Energy Optimization team can help. Check out the datasheet here.

Stay tuned for the next installments of our Pulse on Policy series, where we will dive deeper into the climate provisions in the IRA and share our insights on how these policy changes may impact companies’ energy and sustainability strategies.

Join Our Mailing List

Supply Chain Decarbonization: Your Guide is Here!

Download our new white paper on establishing a successful decarbonization program.

Read More