June 17, 2020

Distributed Generation Series: Navigating Onsite Solar

Aynsley Kretschmar, Analyst, Renewables Advisory & Charley Hildt, Manager, Renewables Advisory

This is the first installment of our Distributed Generation Series that will delve into distributed energy fundamentals; consider this post a table of contents of sorts, to introduce onsite solar topics that we will examine in depth in upcoming posts. Be sure to check back and follow along!

Incorporating onsite solar into your organization’s renewable energy strategy can provide energy cost reduction, strong public relations content, benefits to the local community, and the ability to pursue renewables within regulated utility regions of the United States that often prove difficult for renewable procurement. To that end, it is important for corporate buyers to have a full understanding of how power is valued in their given state or utility region, what contract structures are available to them, what possible locational risks the asset may carry, and which accompanying sustainability claims are tethered to the outcome.

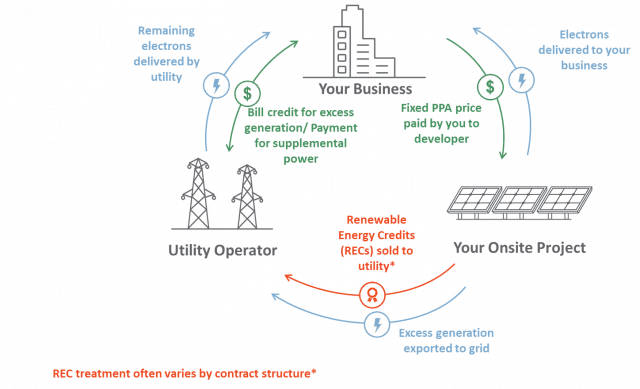

In instances when the production of an onsite solar system is in excess of the facility’s usage, the excess power is pushed back to the grid; in order to compensate for this excess production, many regions of the United States utilize net metering or other methods of distributed generation compensation. In areas with net metering, the local utility will compensate the corporation by providing credits directly on their monthly bill, as shown in Figure 1 below.

Figure 1: Net Metering Process & Compensation

Both the allowable solar asset size and net metering credit value vary by state and utility. Many regions of the US will limit the capacity of an asset based on the client’s annual usage, peaks in demand, or a fixed capacity. Should the solar asset exceed the local limitations, it runs the risk of not being compensated for periods of excess generation. These compensation structures include but are not limited to:

- providing bill credits valued at the kilowatt-hour supply rate reflected on a corporation’s electric tariff,

- fixed values updated by local public utility commissions annually, or

- variable value credits that mimic price fluctuations in the wholesale market.

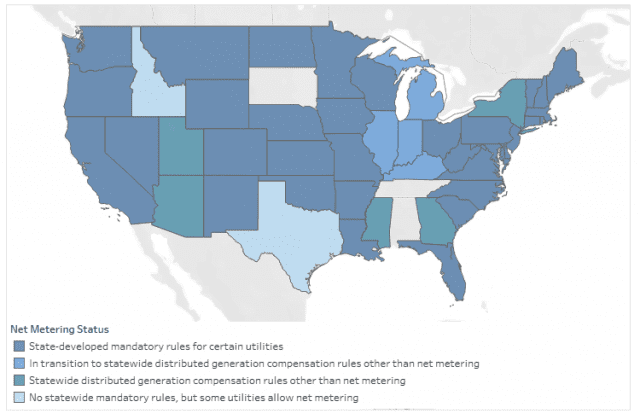

While net metering or other forms of compensation are available in most states, as shown in Figure 2, the type of contract that a corporate buyer can pursue will differ based on state regulations regarding third-party ownership.

Figure 2: Net Metering Status in the U.S. by State

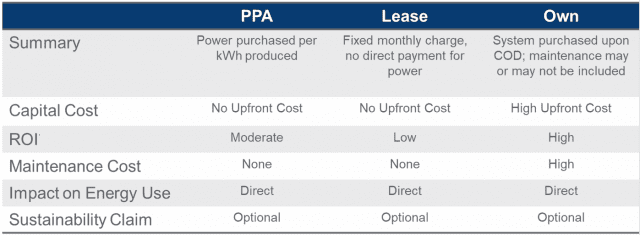

Buyers interested in onsite solar have various contracting options, from power purchase agreements (PPAs) to leases and ownership. PPAs have historically been the most popular contracting structure due to limited upfront costs of installation. If PPAs are prohibited or otherwise restricted by legal barriers – which is the case in many parts of the Southeastern U.S. – but the buyer wants to pursue onsite solar without allocating a significant amount of capital to the project, leases offer a strong alternative. Ownership of the solar asset will result in the strongest ROI but will come with significant upfront cost of capital. This can become prohibitively expensive if a company intends to pursue a portfolio of locations.

Figure 3: Comparison of Onsite Contracting Options

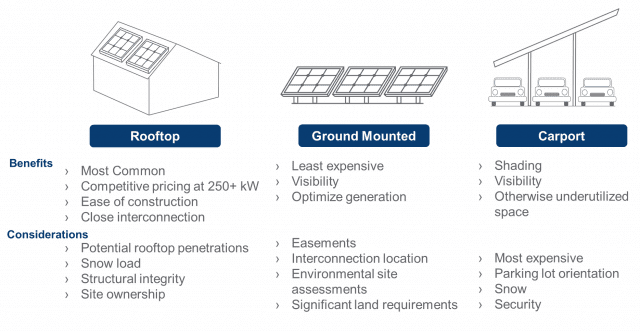

Every onsite solar location comes with development risk. Upfront capital and labor are key components to the cost of onsite solar arrays. Companies should plan to have the solar system operate on location without removal for ten to fifteen years, or alternatively should plan to experience financial losses resulting from removing and then reconstructing the system. The orientation of the solar array, which is determined directly by the facility or location it is constructed upon, will impact the production of the system which in turn impacts the rate of return on the asset. The array would be south facing in an optimal case, but this is not always feasible. Beyond considerations of the physical asset, understanding the facility’s lease or ownership structure is key to obtaining approvals. If the facility is owned, it is best to confirm the intention to remain at the location for the foreseeable future. For locations that are leased, reviewing lease terms and confirming the landlord consents to the installation in advance of a procurement process is critical for onsite solar to be viable.

Figure 4: Onsite Solar Options: Benefits & Considerations

Sustainability claims that can be attributed to an onsite solar asset are directly dependent on whether the company chooses to retain the solar renewable energy credits (SRECs) associated with the system’s generation. SRECs are often valuable, given compliance markets tethered to state Renewable Portfolio Standards, and therefore it is often expensive to retain them. In many cases, the SRECs are sold to reduce the costs of the solar asset. If the company elects a REC arbitrage, the project’s SRECs are monetized and national RECs are provided in their place. Under a REC arbitrage, claims cannot be made to the renewable energy produced by the solar asset, as the RECs are sold as opposed to retired by the company. Instead, corporate buyers with onsite solar often cite benefits to the local community.

Considering onsite solar for your organization? How does onsite generation affect my current annual electricity usage? Interested in learning more about what options and opportunities you have? Reach out to our team; we look forward to connecting with you.